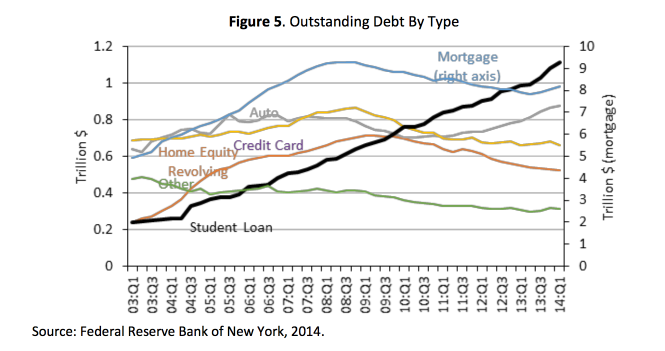

Currently, there is a total of 1.2 trillion student debt in the USA which is higher than auto, personal credit cards, home equity or even mortgage debt. As the largest debt market, it is spiraling in the direction of home mortgage fate: uncontrollable high default rates.

Last week, President Obama announced a plan to provide free community college to students across the country. What does this mean for students? Potentially, 9 million students could save $3,800 each. That could reduce student debt, which is currently an average of $29,400 (2012 data). This is a rare opportunity for legislation to pass in the newly Republican reigning congress which can fulfill the interest of almost every politician in congress from ideology to lobby interests.

The program is based on the “Tennessee Promise” program, which ensures free community college after for the first two years in exchange that students must complete 8 hours of community service a year, have a mentor and maintain a minimum 2.0 (Grade C) average. Originally, the program was designed to increase college graduates to equip their workforce with more education and skills that are in high demand.

Why would the government be interested in expanding this program federally? In a few words: student loan debt. Currently, there is a total of 1.2 trillion student debt in the USA which is higher than auto, personal credit cards, home equity or even mortgage debt. The total student debt level in 2014 is higher than the total mortgage amount in 2007 (right before the Great Financial Crisis). This is incredibly worrisome if we remind ourselves that mortgage debt was one of the major factors that caused global economic crisis due to its poor regulation and massive market embedded in almost all western market with toxic bonds that allowed it to spread throughout the world.

HIGHER EDUCATION AND

STUDENT DEBT”

As the largest debt market, it is spiraling in the direction of home mortgage fate: uncontrollable high default rates. The average default rate on education loans is 14.75% for the 2010 cohort after a three year window of which they could start making payments. Remember these rates only include individuals who fell into default, not those who are not currently paying off their loans due to deferment (extensions that individuals can delay required payments because of unexpected illness, low income or attending graduate school) where there is likely a much higher rate of non-repayment.

The community college plan comes under the guise making education more accessible to low income families. However, another reason to target community college is that the default rate (in $) among college community aid receipts (33.8% for non profit, 49.4% for private) is higher than four year college students (25.4% Freshman/Sophomores and 13% Junior/Seniors). Targeting community colleges, though their average debt levels are lower, is one affordable measure to lower average default rates to keep the student loan debt hazard at bay.

Taking a look at the total amount of principle currently in default by university, you will see that DeVry University has the largest amount of debt currently in default from any other university in the federal student loan program. DeVry’s total outstanding debt is 50 times greater than the average total principal outstanding in default over the past 240 days and also has a higher than average default rate (18.43%). All evidence suggests that DeVry has the most predatory student loan debt in the country and the for-profit publicly traded university does not have the same regulation, standards or transparency requirements that non-profit universities must meet. Yet, even revered education institutions are high in the rankings of total student debt in default: NYU comes in 5th place, Columbia University in 9th, UT Austin in 10th and UPenn in 13th all of which hve varying default rates (Data from the “Orange Book” regarding Federal Perkins Loans). The student debt burden exists for students in ALL types of universities and programs.

Ultimately, reform in student loans is necessary for the interests of bankers, finance and the Department of Education, who bought much of the privately held owned student loan debt since 2008.While this program does provide opportunity to reduce future instability, it does little about impending ongoing problems young loan borrowers face today or reducing the ever-rising college tuition costs. The White House report on higher education and student loan debt policy advice is limited to helping current borrowers make payments, education awareness activities on repayment options, existing social programs or tax benefits, rather than reducing total debt burden. The report is particularly alarming as it suggests to create incentives to serve loan contractors, which echos the predatory sub-prime mortgage lending practices. Every single one of these suggestions serves the interests of the loan distributors and not the students.

While free community college is a noble idea that deserves attention, it will likely have minimal impact reducing inequality and a much greater potential to reduce default rates. Whose interest is this program really serving? Student loan financiers.